As the economy expands and individual assets increase throughout the country, estate planning becomes even more important to safeguarding a secure future. Despite popular belief, estate planning is relevant not only to America’s top one percent but also to the working class. College students need an estate plan, as well. A will allows individuals with families, homes, financial accounts, businesses, or various physical assets to designate ownership after death and mitigate avoidable disputes regarding the property.

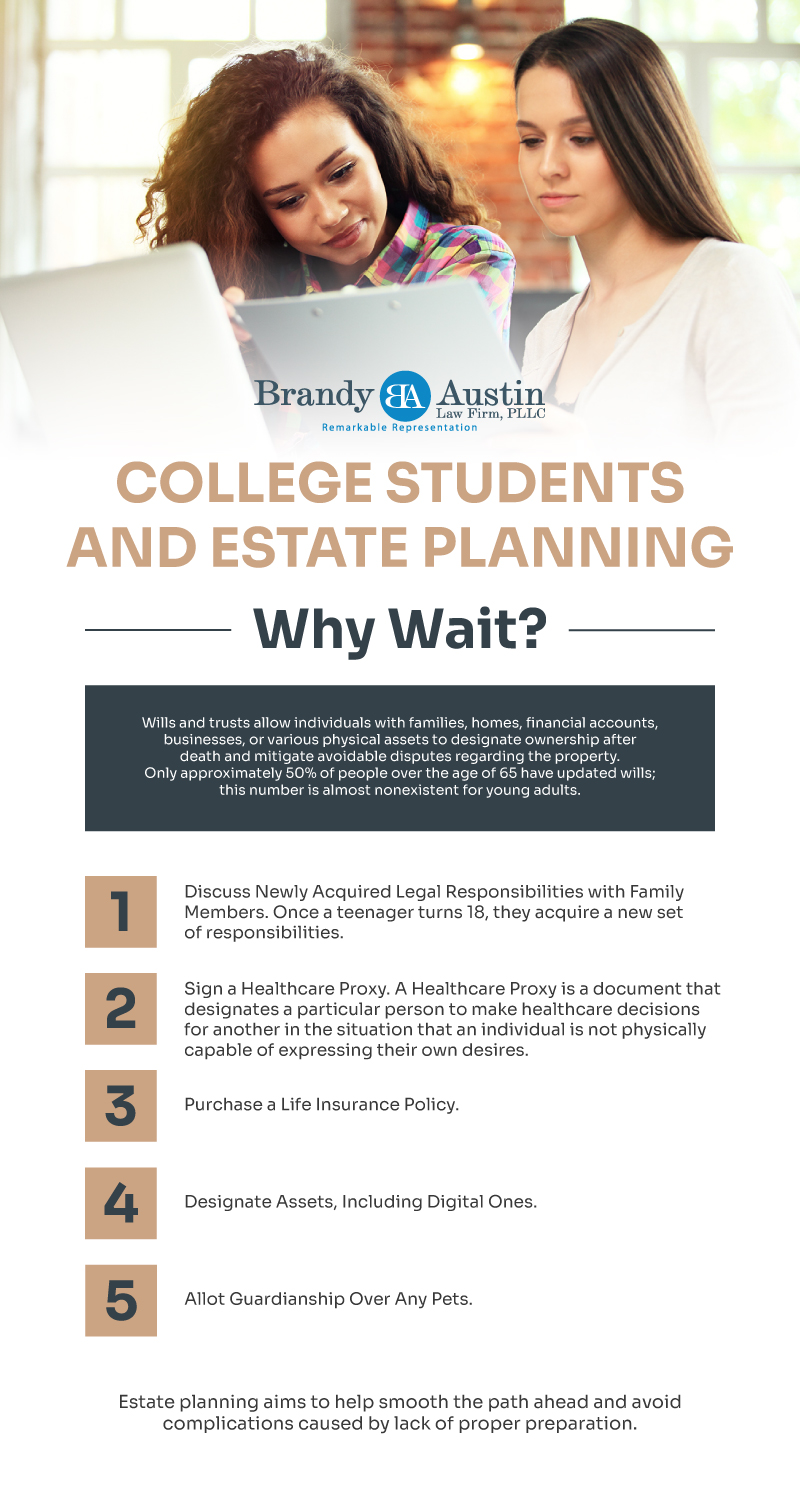

In a sea of misinformation, many individuals question the actual legitimacy of estate planning, especially considering the fluctuating economy and housing market. Only approximately 50% of people over the age of 65 have updated wills; this number is almost nonexistent for young adults. Many attorneys and experts place a heavy emphasis on starting the estate planning process as soon as a young person becomes an adult. At only 18 in most states, an individual obtains all levels of independence, and henceforth carries a variety of responsibilities. These powers often times present themselves as burdens, especially for Americans who lack the knowledge and financial freedom to prepare appropriate estate plans. College students and young adults alike should start planning their estates immediately, despite an apparent lack of assets. There are five simple ways in which young adults can start their estate planning journey ahead of schedule:

Discuss Newly Acquired Legal Responsibilities with Family Members.

Once a teenager turns 18, they acquire a new set of responsibilities. These responsibilities include, but are not limited to, decisions regarding personal health, financial accounts, physical property, and lifestyle choices. Therefore, it is extremely imperative that parents engage in conversations with their young adults about the consequences of these newfound powers.

Sign a Healthcare Proxy.

A Healthcare Proxy is a document that designates a particular person to make healthcare decisions for another in the situation that an individual is not physically capable of expressing their own desires. Designating a particular person to make important decisions regarding life and death ensures that an individual’s healthcare wishes are known and considered, despite any unfortunate circumstances that might otherwise deter such abilities.

Purchase a Life Insurance Policy.

In an era plagued with rising educational costs, many students are greatly burdened by crushing student debt. In the first quarter of 2019, the country’s aggregate student debt rose to $1.49 trillion– a number larger than the national credit card and automobile debt amount combined. In the United States, the average student graduates from a four-year institution with approximately $31,000 in student loan debt, while the average post-graduate student finishes dentistry school –a career path known for its high loan rates– with approximately $300,000 in debt. While federal loans are forgiven if the borrower dies, some private student loans are less understanding and may even accumulate interest after the borrower’s death. Consequently, college students who suffer an untimely death may unintentionally burden their close family members with high student loan payments. Purchasing life insurance policies at a young age is typically extremely affordable as young deaths are especially rare and unpredictable; henceforth, purchasing a policy could prevent saddling family members with unpaid debts and expenses.

Designate Assets, Including Digital Ones.

As previously mentioned, many college students are burdened with tremendous amounts of student debt. As a result, many do not understand the importance of cataloging and designating their assets simply because most do not realize that they logistically have any to give. In 2019, a management study suggested that nearly 49% of individuals without any estate planning documents in place failed to create a will because they believed they had no valuable assets to convey; however, many people forget to consider daily luxuries like vehicles, real estate property, jewelry, or inheritances. Regardless, it is extremely important to plan the distribution of these daily assets so that the desired people receive them. Often forgotten, digital assets are becoming more and more contested as people forget to consider such items before death. Digital assets can include but are not limited to, photographs, hard drives, work files, and social media accounts. As a result, it is more important now than ever before to inform family members where and how to locate information regarding these digital assets.

Allot Guardianship Over Any Pets.

Too many young couples, pets are the millennial equivalent to children. Just like traditional parents typically establish a guardianship plan for human children in case of one or both of their deaths, pet parents should establish similar plans as well. As the number of household pets grows across the country, more people are establishing pet trusts as a means to set aside money for their pet’s future care.

The modern world now demands more of college students and young adults than ever before. With an increased need for education and a general demand for experienced workers, college students are too commonly stretched thin for little pay and minimal benefits. Estate planning aims to help smooth the path ahead and avoid complications caused by a lack of proper preparation. Consequently, it is crucial that college students and young adults alike engage in critical estate management to secure their presents and promote their futures.

Contact our office today online or by phone at (817)841-9906 for your free consultation.